A First National Quarterly Update from Jeremy Wedgbury

- Expert insights

- Dec 2, 2025

- Jeremy Wedgbury, Executive Vice President

As you know, we pride ourselves on providing regular reports on the state of the multi-unit residential housing market and First National’s place within it. This time, we have a lot to unpack, including the new federal budget, a very constructive CMHC policy change, and the beginning of a new era for First National. I’ll begin with market observations.

Resilience in the face of economic headwinds

As expected, the multi-unit housing industry has remained relatively resilient in the face of economic headwinds. Rental apartment construction continues with Montreal leading the way. In Toronto and Vancouver, overall costs are down 10-20%, but economics remain challenging.

With the Canadian economy potentially decelerating due to tariffs, two recent downward adjustments to Bank of Canada interest rate policy are providing stimulus. However, in its late October announcement, the BoC noted that monetary policy alone cannot address the country’s challenges. On cue, the government introduced its “Canada Strong” fiscal plan on November 4th.

Build Canada build!

The budget presents a very welcome $20 billion addition to the Canada Mortgage Bond (CMB) program dedicated exclusively to support multi-unit rental housing insured by CMHC. While First National has many funding sources, the CMB increase will strengthen market liquidity, feeding much-needed supply. This move will ensure mortgages, including large-scale apartment loans, can be efficiently funded.

Our expectation is this increase will begin with a $5 billion quarterly addition to the first CMB pools of 2026. These funds will be available for rental apartments, student housing and seniors’ residences. Through the CMB increase and $13 billion for the “Build Canada Homes” program, the government is demonstrating it understands the need to accelerate affordable home supply. We are also seeing some provincial governments moving to streamline their development processes, supporting a more positive investment environment.

CMHC updates MLI Select product policies

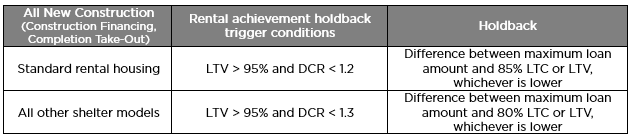

Last week, CMHC updated certain aspects of its multi-unit mortgage loan insurance programs. One such update clarified when a rental achievement holdback would be triggered, as shown in the table below.

CMHC is also updating MLI Select’s energy efficiency qualifying criteria for new construction loans, effective September 30th, 2026. Please contact your First National advisor for more insight.

First National’s performance

Through the first nine months of 2025, First National’s originations grew smartly over the prior year, pushing our commercial mortgage book to a record $64.1 billion. What’s notable is that our quarterly commitment volumes also increased markedly as did our construction book. As noted above, pro formas for some projects are challenging but as recent growth demonstrates, First National is prepared to support developments that work.

Canada’s largest apartment lender, by far, thanks to you

With growth this year, First National has further advanced our standing as the largest multi-unit lender in Canada. We hold this position because of your support and the hard work of my colleagues. Thank you!

A new era for First National

After 19 years as a S&P/TSX-listed public company, Birch Hill, Brookfield and First National’s two founders – Stephen Smith and Moray Tawse – took First National private in late October. We’re excited by this development, and the continuity brought by Moray and Stephen’s ongoing ownership, as it presents us with a new opportunity to grow and innovate while meeting our long-standing commitment to Better Lending for you.

Looking ahead with insured and conventional options

We expect to start 2026 on a growth footing as a CMHC-approved multi-unit lender. That said, please keep in mind that First National has added a new Better Lending service to bring you the market’s most competitive conventional financing options. We are doing this on a brokered basis, and it means we are now a one-stop shop for insured and conventional mortgages. I encourage you to speak to your First National advisor about the full range of options now at your fingertips across different real estate asset classes.

And finally, for risk management purposes, we continue to advocate for 10-year terms, despite the incremental difference in cost relative to 5-year money. For long-term, cash flowing apartment assets, insured 10-year mortgages align perfectly and remove the risk of shorter-term renewal into a market five years from now that may not be nearly as favourable. Locking down borrowing costs for a decade also makes it easier to plan.

We look forward to working with you in the months to come.

Sign up for Market updates

Looking for advice and insights on commercial real estate? Sign up today for the Market Update email.

Related Articles

- Market Commentary: CMHC Outlines CMB Issuance Plans

- Policy and advocacy outlook for 2026: Q&A with Tony Irwin, President of Rental Housing Canada

- How multifamily developers are adjusting to Alberta’s market slowdown

- First National updates commercial lending outlook for 2025, comments on purchase transaction

- CMHC is making important changes to multi-unit mortgage insurance. Here is what you need to know.

- A Return to Real Estate 101 — Resetting Expectations For Multifamily Housing